Economic Overview

The dominant theme in the global economy during the September quarter continued to be the prospect of the US Federal Reserve’s tapering of its stimulus program. With US economic signals still mixed, ‘The Fed’ surprised markets in September by postponing its monthly $US85 billion bond buying program.

The Fed expressed it was disappointed with the speed of improvement in the job market and downgraded its economic growth forecasts.

The Eurozone emerged from a two-year recession, yet its banking system remained weak. While in the UK, The Bank of England upgraded its growth forecasts for the rest of the year.

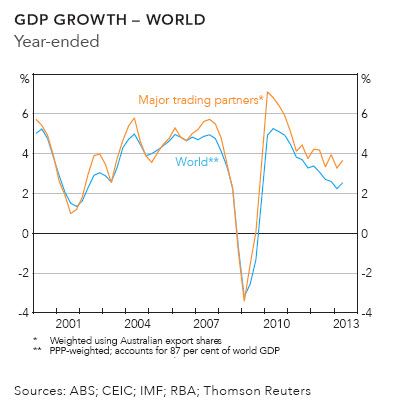

China appeared to be emerging from its slowdown, with improvements in retail, industrial output and exports. India, however, found its currency at record lows as inflation soared and growth hit a 10-year low.

Australia grew at an annual pace of around 2.5% and unemployment rose to a 4-year high of 5.8%. Mining investment showed signs of peaking, consumer spending remained soft, yet interest rate cuts were beginning to be felt in the housing sector.

Market Overview

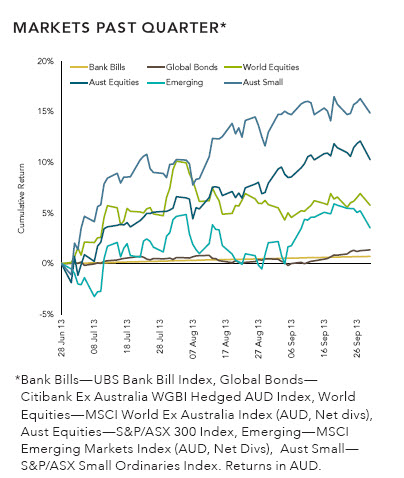

The benefits of international diversification were highlighted in the September quarter with divergent performances by Australian, developed and emerging equity markets.

Having lagged the world in the previous quarter, Australia recorded its best quarterly performance in four years. The gain of over 10% doubled that of developed markets broadly and tripled the return from emerging markets.

The Australian market also took encouragement from early indications of a lift in domestic demand as the RBA’s rate cuts and lower Australian dollar fed through. This news boosted sectors linked to the economic cycle, like consumer discretionary and industrials. In contrast, the less defensive mood left sectors like healthcare, utilities and REITs lagging.

In Europe, the easing of Eurozone concerns helped fuel strong equity gains by Spain and Italy, while over in the US the market hit record highs after the Federal Reserve decided not to taper its bond buying program.

Emerging markets again slipped behind their developed counterparts, this reflected the ongoing belief of reduced capital flows if the Federal Reserve had tapered its bond buying. There were divergences though; while India and Indonesia underperformed, Korea and Russia had solid gains.

Gold continued its volatile run, racing to an almost yearly high in late August, before erasing virtually all of those gains as it plunged during September.

In fixed interest, term and credit premiums narrowed, again as a result of the Fed’s change on tapering. Longer dated bonds outperformed shorter dated, while corporate debt beat government debt.

The randomness of returns chart remained random. Once again it reveals no discernible pattern over the previous three years of quarterly returns, showing there’s no better choice than diversification. After a poor June quarter Australian small companies pulled themselves off the canvas this quarter to lead the pack, followed by the Australian large cap sector. Global equities showed more modest returns after a strong June quarter, while Global REITs (the only negative asset class this quarter) finally slipped into the red with a 2.12% loss after seven consecutive quarters of growth.

Investment Strategy Recognised

We’ve long strived to find the best investment options available. This means ignoring fads and focussing on rigorous research. Currently, much of the investment strategy we implement comes with the benefit of consistent historical data and decades of academic backing.

So it gave us great pleasure recently to see one of the pioneers of that academic research, Eugene Fama, awarded the 2013 Nobel Prize in Economic Sciences. Fama’s research is the reason we emphasise the futility of picking stocks and making predictions. It’s also the reason we encourage investment discipline over guessing what the market will do next.

“Fama’s research at the end of the 1960s and the beginning of the 1970s showed how incredibly difficult it is to beat the market, and how incredibly difficult it is to predict how share prices will develop in a day’s or a week’s time,” said Peter Englund, professor in banking at the Stockholm School of Economics and secretary of the committee that awards the Nobel Prize in Economic Sciences. “That shows that there is no point for the common person to get involved in share analysis. It’s much better to invest in a broadly composed portfolio of shares.”

The Australian University of Property Spruiking

We’ve previously warned property spruikers are back and unregulated as ever, so we thought it was time to find out how qualified those property ‘advisers’ actually are with a little quiz:

1. To become a property investment adviser, what educational qualifications are required?

- Diploma in Financial Services

- Diploma in Real Estate

- Bachelor of Business

Answer: none of the above.

You can advise someone on buying a million dollar property, yet you are not obligated to have any educational qualifications.

2. The compulsory continuing professional development requirements for a property investment adviser are:

- Attendance at the national conference (15 hours)

- Equivalent of 20 hours which can include attendance at seminars, conferences, guest speaking

- Equivalent of 30 hours which must include attendance at the national conference.

Answer: none of the above.

Why would you have to do any ongoing training or development to keep up your skills if there was no minimum training or education requirements when you first started in the job?

3. The licensing requirements to become a property investment adviser include:

- Police check

- Minimum entry educational qualifications

- Endorsement from two current property investment advisers

- All of the above

Answer: none of the above.

You would think that someone who is advising you on making one of the biggest decisions in your life would be obligated to be licensed. Well, you thought wrong.

4. The regulatory body that oversees the property investment advice industry is:

- Real Estate Institute of Australia

- The Financial Advisers Commission

- Australian Securities and Investments Commission (ASIC)

- A and C

Answer: none of the above.

You would hope that a large and powerful organisation such as Australian Securities and Investment Commission (ASIC) would be keeping an eye on investment advisers who are involved in some of the most important and expensive life decisions people will make. Unfortunately this is not the case. “Why?” I hear you ask.

The simple answer is real property is not considered a “financial product” under the Corporations Act. Anyone can give advice on real property and is not obligated to abide by the Corporations Act nor do they come under the scrutiny of ASIC.

Source: theconversation.com/au

She’ll be right, mate!

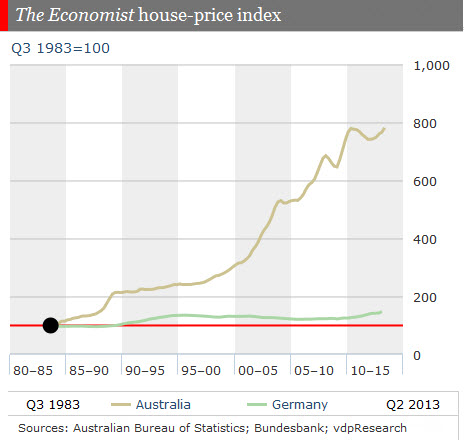

Finally, an interesting comparison of central bankers and possibly cultures. As debate again began to rage over the prospect of low interest rates fuelling a property bubble in Australia, the RBA’s Head of Financial Stability, Luci Ellis said the following:

“I think there are a lot of people, the minute housing prices start to pick up they say, ‘Oh my goodness, we’ll all be rooned.’ The minute housing prices start to pick up they imagine it’s a bubble.”

In contrast, the German Central Bank sounded a note of caution in its monthly report after an 8.25% rise in German property prices over the past three years, saying:

“Housing prices in German cities have been rising so strongly since 2010 that a possible overvaluation cannot be ruled out.”

And to give the statements a little context, according to The Economist:

Australian property prices, 46% overvalued against rents and 24% overvalued against incomes.

German property prices, 15% under-priced against rents and 18% under-priced against incomes.

With thanks to DFA Australia.

This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly. Mancell Financial Group is an Authorised Representative No. 226266 and Credit Representative No. 403187 of FYG Planners Pty Ltd, AFSL/ACL No. 224543. ABN 29 009 541 253 This information is general in nature and readers should seek professional advice specific to their circumstances. Searching for the top financial adviser in Australia?