Earlier this year we highlighted the impact the winding down of the mining boom was having on real estate in Port Hedland, Western Australia. Now the doom and gloom has spread across to the east coast.

The latest town to experience serious property pain is Gladstone, Queensland.

It has had some serious investment around port facilities and liquid natural gas plants, with money spent in the billions. At the same time property developers moved in build and capitalise on the expected demand for real estate. Things peaked for real estate back in 2013 though. Since then anyone buying on the great expectations surrounding the LNG developments would be licking their wounds.

The unfortunate thing was a bunch of unqualified property experts had been talking up Gladstone like it would be a never ending river of gold. Their general case for property investment revolved around the LNG projects that were being built and upgrades at the local port for coal exports.

The “experts” would talk of the billions being spent and toss in some random quotes from an International Energy Agency report about LNG demand to make their nonsense appear researched. Finally they’d top it off with the suggestion the projects and the expected international energy demand made Gladstone a lower risk environment.

They somehow managed to miss the key issue. Gladstone prices and rents would be driven up and then likely ripped downward again by one thing – an influx and outflow of workers.

Gladstone Regional Council’s website, highlighting the scope of the projects being built, indicated how this would play out. The LNG plants required nearly 10,000 workers to build, yet when operational the plants would require just over 400 workers to run them.

Cue the pain for the property investors.

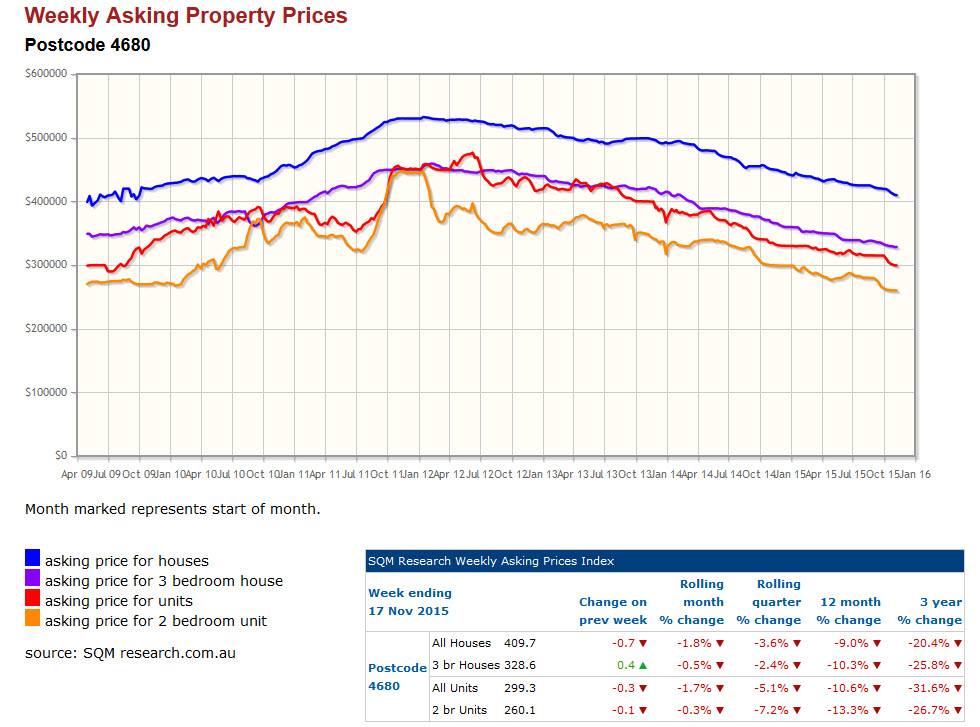

The following chart from SQM Research shows the decline in listed property prices across Gladstone. A 20% decline in the last 3 years for houses and a 31% decline in units.

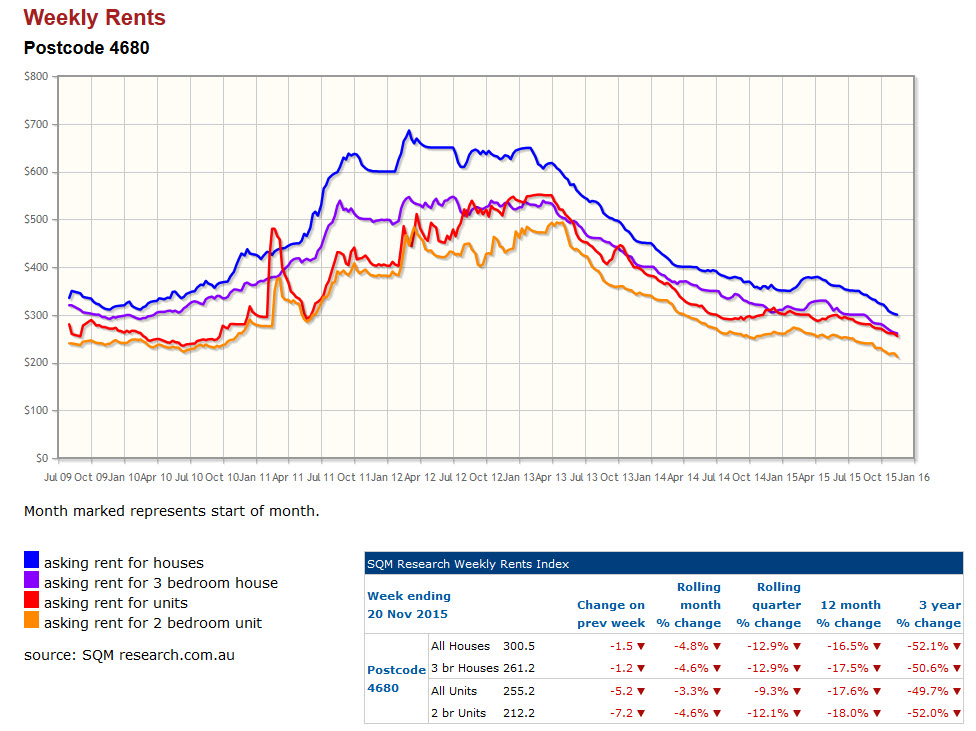

While this chart shows the decline in rental prices across Gladstone. A 52% decline in the last 3 years for houses and a 49% decline for units.

As the local Gladstone newspaper says, it’s panic stations for investors and rental agents.

A rising number of homes are being taken by banks and in the past few weeks one real estate agent has been forced to evict tenants on two occasions because the house has been repossessed.

In a year, the average price of a rental house has dropped from a minimum of $320 to as low as $150. A brand new home that would have been rented for at least $450 a week in November 2014, is now about $320.

If there’s one thing agents do agree on, it’s that sliding rents are a result of simple supply and demand. However, there’s concern that some agents and owners are letting rents drop too low, and in turn devaluing the entire property market – causing long-term damage and turning investors off buying.

Again, this highlights the many dangers of real estate speculation in the next hot town or region. At the end, it’s still a single high priced asset anchored to the fortunes of the location it sits in – extremely undiversified. And with the propensity for Australian real estate gurus to suggest their followers put as little money down as possible and use interest only loans, there would seem to be a great deal of suffering ahead to any investor who bought into the story of Gladstone’s booming real estate future.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.