There is a good reason we continue to highlight the benefits of discipline, keeping your emotions in check, not reacting to market movements and ignoring emotive news headlines.

It’s because history has shown the investors who can’t be disciplined, put aside market movements and media headlines, will inevitably suffer lower than market returns.

The recent correction has provided a great opportunity to illustrate exactly how the media responds throughout two months of volatile market movements. Importantly, we can demonstrate these media reactions while the correction is still fresh in all of our minds.

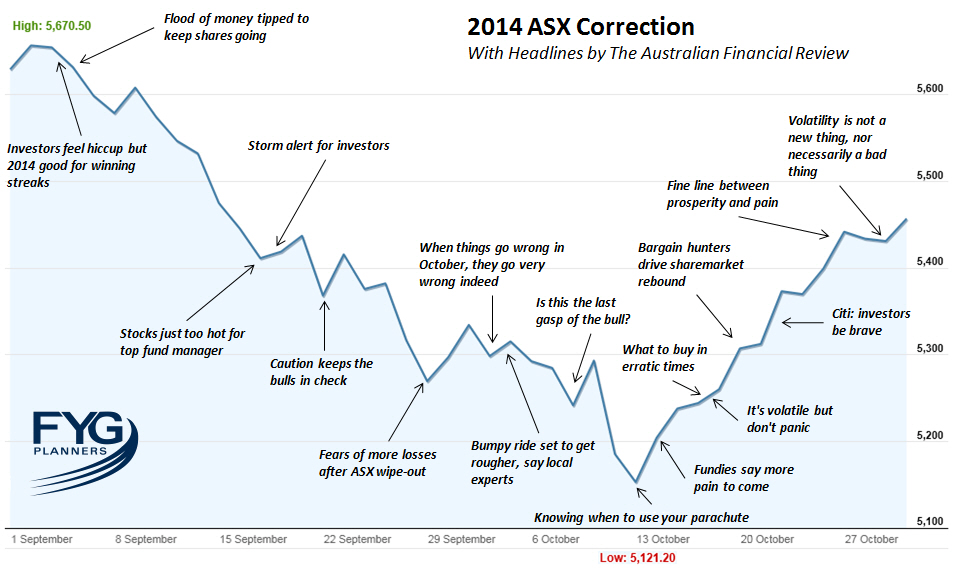

Below is a chart of the ASX All Ordinaries from the beginning of September until close of trade on October 30.

Overlayed are actual headlines from the Australian Financial Review with arrows indicating when they were published during the correction. We’ve observed these headlines as being an accurate barometer of how the media reported the correction throughout September and October 2014.

At the beginning of September the ASX was near its high point for the year and the equity headlines were positive, with a “Flood of Money Tipped to Keep Shares Going”. From there, the market had a swift decline and halfway through September the AFR noted a “Storm Alert for Investors”.

As the declines continued readers are told of “Fears of More Losses After ASX Wipeout” along with a story detailing past market horrors in October. This one is written every year because the 1929 and 1987 crashes happened during October. Strange that the other 80 odd Octobers that were relatively uneventful haven’t rendered this story useless by now, but journalists need to write stories so they can eat.

Early October and AFR asks “Is This the Last Gasp of the Bull”, while local investment experts begin musing on further bad times ahead – at this stage the market was down over 7%. The market declined another 2% before hitting bottom for the correction. Notably, this was the exact point the AFR capitulated and started talking about bailing out, writing “Knowing When to Use Your Parachute”.

The market moved off the bottom and posted consecutive positive days for over a week. During this time AFR reminded us “It’s Volatile, but Don’t Panic”. A headline that would have been more useful a month earlier after the market had dived and they talked of a “Storm Alert for Investors”.

As the market continued to pull back losses, the reminders about buying opportunities appeared. Yet there were significantly better buying opportunities when they told us to use our parachutes! With the market going up again AFR clearly felt safer about suggesting it was time to buy.

When the market shot back into positive territory for the year, AFR decided to roll out their hindsight machine and smugly suggest “Volatility Is Not a New Thing, Nor Necessarily a Bad Thing”. Again, something that would have been more useful before or during the correction, not when it appeared safely behind us.

We understand market declines can be emotionally trying because as the market falls, so does the equity portion of your portfolio, but here we can see how the media can exacerbate those feelings of nervousness by acting as some form of authority on what’s ahead.

As the headlines on the chart show, they have absolutely no idea what is happening. They’re in reaction mode and their predictions and advice are late, wrong and ignorant.

When the market was at peak they predicted it would continue. After the market fell for half a month they started the panic headlines. When the falls continued, the panic headlines turned to doom with a reminder of past crashes.

As the market bottomed out, they gave advice on jumping. When the market moved upwards for over a week, they then reminded us not to panic. As the market continued to move upward they told us about the bargains we should buy and reminded us to be brave!

Finally, with the market back in positive territory, and after all their emotion charged headlines, they brazenly tell us what just happened isn’t new, nor a bad thing!

Little wonder why today’s newspapers are lining bird cages tomorrow.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.