Want to better understand index and portfolio performance? Subscribe to our YouTube Channel where we break down the historic performance of the indices many popular ETFs track.

The ASX 200 – it’s often referenced, but few of us really know what’s behind that number we’re quoted on the nightly news. So get ready for some useful information because you’re about to find out what the ASX 200 is really made up of!

If you hold any share fund this will also be a good illustration of what a share fund can be comprised of because most funds are often based on a particular index or they attempt to mimic the performance of an index.

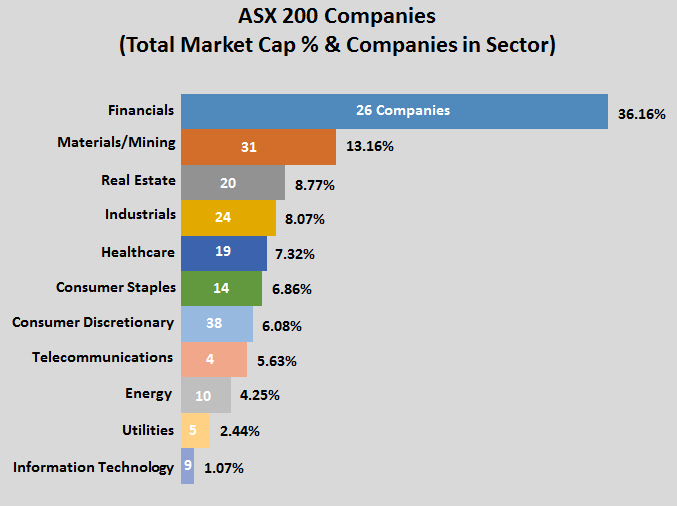

The most basic thing to understand is the ASX 200 represents the largest 200 companies in Australia measured by their market capitalisation (the total value of all their issued shares). The 200 companies are grouped into 11 industry sectors and when you start looking at those companies and those sectors this is what you’ll find.

Financials make up more than a third of the ASX 200 by size, yet in terms of the number of financial companies as a percentage of the ASX they make up only 13% – and there’s a reason for this you’ll see later.

Materials & mining make up 13% of the index by size. This comprises mining (BHP, RIO Tinto etc), agriculture (Nufarm, Incetec Pivot etc) and construction materials (Boral, James Hardie etc). This sector has given up ground in recent years as the mining boom has wound down and the larger companies such as BHP and RIO have seen their share price and market caps decline.

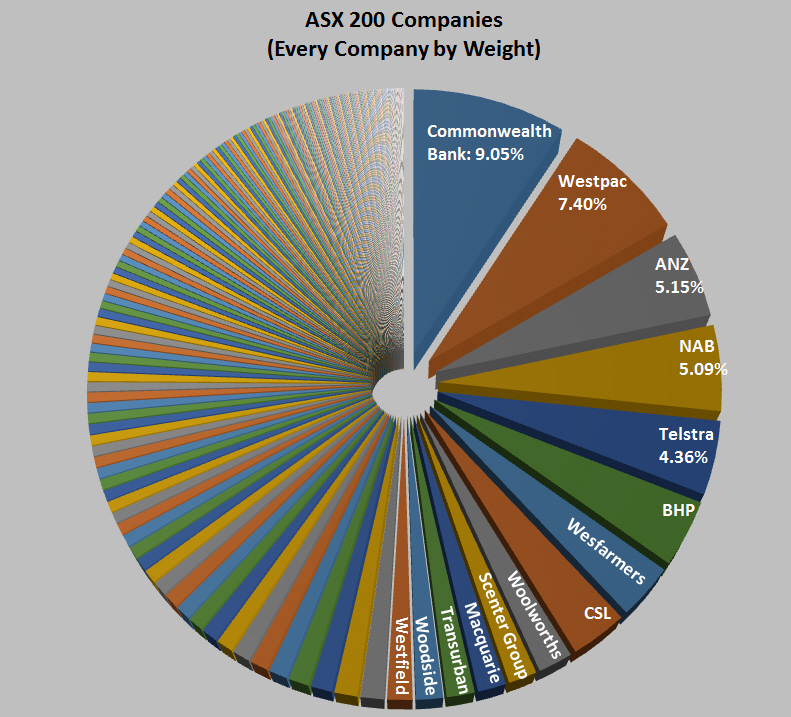

When broken down by company it becomes apparent why financials make up over a third of the index – the big four banks dominate the ASX 200. They comprise over 26% of the index themselves.

Drilling down further you can see the largest 14 companies comprise over 50% of the index. The two largest companies, Commonwealth Bank and Westpac both have market caps over $100 billion. There are 29 companies with a market cap between $100 billion and $10 billion, 131 companies with a market cap between $10 billion and $1 billion, while the final 38 companies have a market cap under $1 billion, the smallest is LNG Limited with a market cap of $304 million.

When the largest companies have a good or bad day it’s assured the ASX 200 will follow. Meanwhile, if LNG, or any of its friends at the bottom, have a good or bad day the index is unlikely to feel it.

We’ve had questions in the past as clients attempted to get their head around being invested in funds. They’ve seen their friends or family invested with a handful of companies like Commonwealth Bank, Telstra and BHP and wondered why they have a handful of funds instead of a handful of companies.

The answer is diversification.

Along with Commonwealth, Telstra and BHP, in an ASX 200 fund you also own 197 other companies.

A good way of understanding an investment into a fund based on the ASX 200 would be to use $10,000 as an example investment. Invest $10,000 into an ASX 200 share fund when this data was compiled in late March and you would consider yourself the owner of $905 worth of Commonwealth Bank shares and $740 of Westpac shares etc. When it comes to LNG, the smallest company in the index, you’d have about $2 worth.

Finally, it’s important to remember investing in a fund based on the ASX 200 does offer some diversification, but you’re still stuck in one country and you’re largely dominated by one sector. The Australian market is hopelessly lopsided because of the banks, so while now you know what’s in the ASX 200, you also know why it’s important to be globally diversified.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs. Needing help with your financial future? We think we’re Australia’s best financial advisor, click to see the reasons why.