If you’ve ever wondered about the impact psychology can have in real estate or financial markets, look no further than Toronto in Canada.

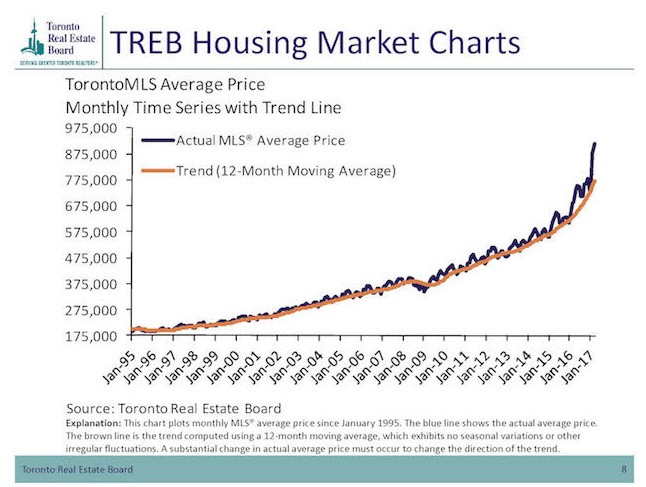

Between March 2016 and March 2017, the greater Toronto area turned into Canada’s hottest real estate market, with prices soaring 33% in a year from $688,000 to $916,567 for a free standing home, while in the city itself homes hit $1.5 million. The market turned into a gladiator pit.

Open houses would be crawling with potential buyers. Every offer on a property had to be over asking price. Real estate agents would hold blind auctions with offers to be submitted by a certain date. Desperate buyers would be expected to submit those offers without any inspection conditions – home inspectors were actually experiencing large drops in their business.

As the prices raced higher so did Canadian’s debt levels. As a percentage they grew to 167% of Canadian household income, or $2.029 trillion which is slightly bigger than Canada’s whole economy.

This prompted some hand wringing from the Governor of the Bank of Canada, Stephen Poloz. Last month, in reaction to the price increases, Poloz said “there’s no fundamental story that we could tell to justify that kind of inflation rate in housing prices.”

Even normally mealy-mouthed economists from Canada’s big banks stated the market was a bubble and in dangerous territory. The Bank of Montreal outright called Toronto’s market a housing bubble, while Toronto Dominion Bank said “home prices across the GTA and surrounding areas appear to be detaching from fundamentals and are simply unsustainable.”

But homebuyers weren’t interested in listening to the eggheads, they just wanted to borrow and buy that house before prices went any higher.

Then Home Capital happened.

Home Capital is one of Canada’s largest alternative lenders – the place you go when you want a house but the big banks won’t touch you. In late April the Ontario Securities Commission accused Home Capital of making materially misleading statements to shareholders in 2015 when it failed to disclose it had terminated 45 mortgage brokers who were inflating applicants’ assets and incomes to get approval.

This sparked a crash in Home Capital’s shareprice and a run on their deposits, as they were funding by offering high interest savings accounts. To save themselves from immediate disaster as their liquidity evaporated, Home Capital took an emergency $2 billion loan at kneecap rates from the Healthcare of Ontario Pension Plan.

In the weeks since the Home Capital debacle became news, the froth suddenly disappeared from Toronto’s real estate market. Real estate agents and mortgage brokers suggest it significantly sapped confidence in the market. The bidding wars are over. In the first two weeks of May sales fell 16% and homes listed for sale increased 47%.

In media articles real estate agents are reporting many open homes no longer have any attendees. Anecdotal stories of buyer’s remorse are emerging. Real estate lawyers have had buyers asking how to get out of signed deals. One lawyer said he had four calls in a couple of hours from buyers who admit they overbid and are fearful they bought at the top. One seller had the buyers show up at his doorstep a few days after signing a contract. They pleaded to be let out of the deal – their winning bid was $225,000 over the asking price!

As you can see, when it comes to money and the most emotional of assets – a house, humans aren’t the most rational creatures. One day a buyer is desperate to offer hundreds of thousands over asking to be the winning bidder of a house in a hot market. Some new information appears only days later and they’re desperately wanting nothing to do with that house, fearful they’ve paid too much.

From greedy to fearful in record time.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.